Introduction

Advisory Shares: Unlocking the Power of Strategic Partnerships

In the fast-paced and competitive enterprise landscape, corporations are constantly looking for approaches to benefit a competitive part. One method that has received large traction in latest years is the issuance of advisory stocks. These stocks offer a unique opportunity for agencies to tap into the information and steering of enterprise experts, at the same time as also offering a precious incentive for advisors to make a contribution their knowledge and insights.

In this comprehensive manual, we can delve into the world of advisory shares, exploring their significance, diverse types, advantages, and risks. By understanding the intricacies of advisory stocks, agencies could make informed decisions that may doubtlessly rework their growth trajectory.

Equity Compensation

Equity Compensation: The Power of Shared Success

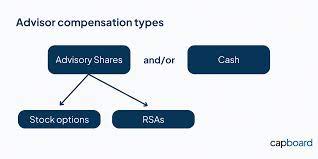

When it comes to compensating advisors, corporations often face a catch 22 situation among coins reimbursement and equity compensation. While coins compensation provides instantaneous financial rewards, fairness reimbursement aligns the interests of the marketing consultant with the long-time period fulfillment of the employer. In this phase, we can compare and comparison those two repayment strategies, highlighting the benefits and disadvantages of every.

Furthermore, we will explore commonplace types of equity compensation: Restricted Stock Awards (RSAs) and Stock Options. We will discuss how these instruments work, their implications for both the consultant and the enterprise, and the elements that businesses need to bear in mind when deciding which kind of fairness reimbursement to provide.

Additionally, we will shed mild on vesting schedules – a critical factor of equity repayment that determines when advisors can exercising their rights to the stocks. We will even delve into the complicated global of tax implications associated with fairness reimbursement, making sure that agencies are aware of the capacity tax obligations that come with issuing advisory stocks.

Issuing Advisory Shares

Navigating the Path to Issuing Advisory Shares

Issuing advisory shares includes a chain of important steps that require cautious consideration and planning. In this segment, we can manual businesses through the process of determining the precise amount of equity to offer to advisors. We will explore numerous methodologies used to calculate equity, taking into consideration elements inclusive of enterprise norms, marketing consultant expertise, and the potential impact at the enterprise’s capital shape.

Negotiating the advisory settlement is any other vital issue of issuing advisory stocks. We will provide insights into effective negotiation techniques, ensuring that groups strike a stability between assembly the needs of both events worried. Furthermore, we can talk great practices for drafting advisory agreements, highlighting key clauses that need to be included to shield the pastimes of each the business enterprise and the consultant.

Legal considerations are paramount in relation to issuing advisory stocks. We will discover the legal necessities and rules that groups need to adhere to, ensuring compliance with applicable laws. By know-how the legal landscape surrounding advisory shares, organizations can mitigate potential risks and make sure a smooth issuance system.

Managing Advisory Shares

From Issuance to Optimization: Managing Advisory Shares

Once advisory shares were issued, it’s far vital for companies to correctly manipulate them. This section will delve into the techniques and gear required to music advisory shares correctly. We will discuss the significance of maintaining complete information and imposing strong systems to screen percentage possession and vesting popularity.

Reporting on advisory stocks is essential for transparency and compliance purposes. We will explore the reporting necessities that organizations should fulfill. Ensuring that they provide correct and well timed facts to applicable stakeholders. Additionally, we are able to talk valuation methodologies for advisory shares. Losing light on how agencies can determine the truthful cost of those shares.

Transferring advisory stocks can turn out to be a need under positive occasions. Whether it is because of adjustments in commercial enterprise ownership or restructuring. Knowledge the system of transferring advisory shares is important. We will offer steerage on a way to navigate these conditions while shielding the hobbies of all parties worried.

Lastly, terminating advisory agreements may also grow to be necessary if the relationship among. The guide and the organisation not aligns with their mutual desires. We will explore first-rate practices for terminating advisory agreements in a professional way whilst minimizing potential conflicts.

Real-Life Examples

Learning from Real-Life Experiences: Case Studies on Advisory Shares

In this very last phase, we will delve into actual-lifestyles examples of organizations that have efficiently utilized advisory stocks to their benefit. These case research will spotlight how companies have leveraged advisory stocks to benefit strategic insights, accelerate growth, and conquer demanding situations.

Furthermore, we are able to talk achievement tales from advisors who have made large contributions to businesses. Via their involvement with advisory stocks. By expertise these actual-life experiences, corporations can advantage valuable insights into how. They are able to maximize the advantages of issuing advisory stocks within their personal organizations.

However, it’s far equally vital to analyze from errors made via others. We will discover common pitfalls and mistakes related to advisory stocks. Offering groups with precious classes which could assist them avoid comparable missteps.

Lastly, we will explore destiny trends in advisory stocks. As generation evolves and business landscapes retain to shift. It is crucial for companies to live beforehand of rising traits with a purpose to stay aggressive. We will talk capability developments in advisory proportion structures and practices which could shape the panorama in the coming years.

Conclusion

Advisory stocks provide a effective mechanism for corporations to tap into outside know-how, align incentives, and pressure boom. By expertise the importance of advisory stocks, exploring fairness repayment alternatives, navigating the issuance procedure efficaciously, handling advisory stocks effectively, learning from actual-existence examples, and staying abreast of future developments, businesses can release the whole potential of strategic partnerships through advisory stocks. With careful planning and execution, advisory shares can end up a catalyst for achievement in state-of-the-art dynamic enterprise environment.