The History of United Technologies’ Transformation into a Conglomerate

United Technologies formed in 1929 from the merger of textile company Carrier Corporation and elevator manufacturer Otis Elevator Company. Over the 20th century, leadership diversified dramatically into aerospace and building systems through acquisitions of Pratt & Whitney, Hamilton Sundstrand and Carrier air conditioning.

This conglomerate approach let United Technologies own stakes across lucrative fields underpinning global transportation and infrastructure needs. Financial stability also improved by balancing the portfolios cyclical market trends. They rebranded as United Technologies Corporation in 1975.

The Decision to Split into Three Companies: United Technologies, Otis, and Carrier

After surpassing $66 billion in annual sales,UTC’s sprawl became unwieldy from both business and investor perspectives. Central management struggled to provide specialized support across such technically distinct business units. Leadership also fielded activist investor calls for reorganization to optimize the valuations of companies swallowed up within UTC.

The Influence of Activist Investor Dan Loeb and His Suggestions for the Split

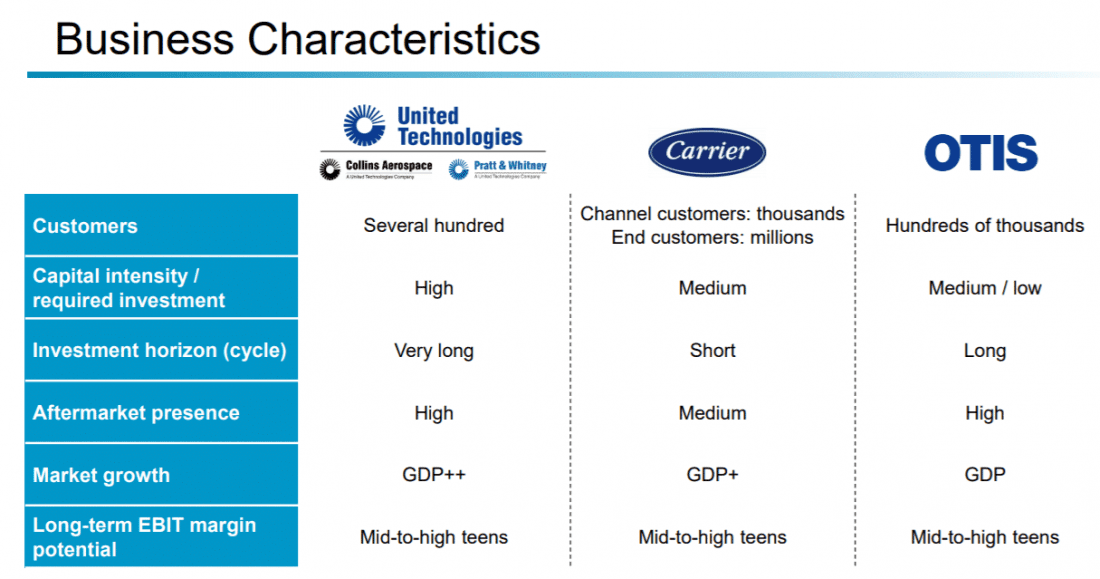

Shedding Otis and Carrier to operate independently should empower those brands to hone strategic focus exclusively on their verticals. Meanwhile United Technologies can also redirect its full energies towards pushing boundaries in aerospace technologies. As all factions chase product innovations faster, their respective values grow.

The Benefits of Specialization and Focusing on Specific Business Areas

Freed from UTC, newly rechristened Otis anticipates leveraging software developments in the Internet of Things, AI and predictive analytics to revolutionize elevator maintenance. As urban density increases globally alongside cloud-connected infrastructure, Otis wants to lead smart city transportation.

The Opportunities Ahead for Standalone Otis Elevator Company

New elevator and escalator installations should also accelerate, especially in developing markets as India, Indonesia, Thailand and Egypt rapidly expand. Otis’ strong international brand recognition positions them well to capture many of those large scale projects.

The Potential for Each Independent Company to Become a Leader in its Respective Industry

With United Technologies paving the way, other industrial conglomerates will evaluate whether consciously uncoupling various operations might enhance their valuation and agility. As digitalization disruptions demand companies constantly iterate to stay ahead, more tightly targeted business units should react quicker.

Lessons for Other Conglomerates Eyeing Specialized Splits

However, spins-offs come with separation costs and one-time tax hits. The process also risks productivity dips surrounding the transition across organizations. So companies need both financial and cultural readiness to divide successfully.

| Company | Areas of Focus | Key Brands | Revenue |

| Pre-Split United Technologies | Conglomerate spanning aerospace, elevators, HVAC, fire & security | Pratt & Whitney, Otis, Carrier | $66+ billion |

| Post-Split United Technologies | Aerospace & defense technology | Pratt & Whitney, Collins Aerospace Systems | $59+ billion |

| Carrier | HVAC, refrigeration, fire & security systems | Carrier | $18+ billion |

| Otis | Elevators, escalators, moving walkways | Otis | $12+ billion |